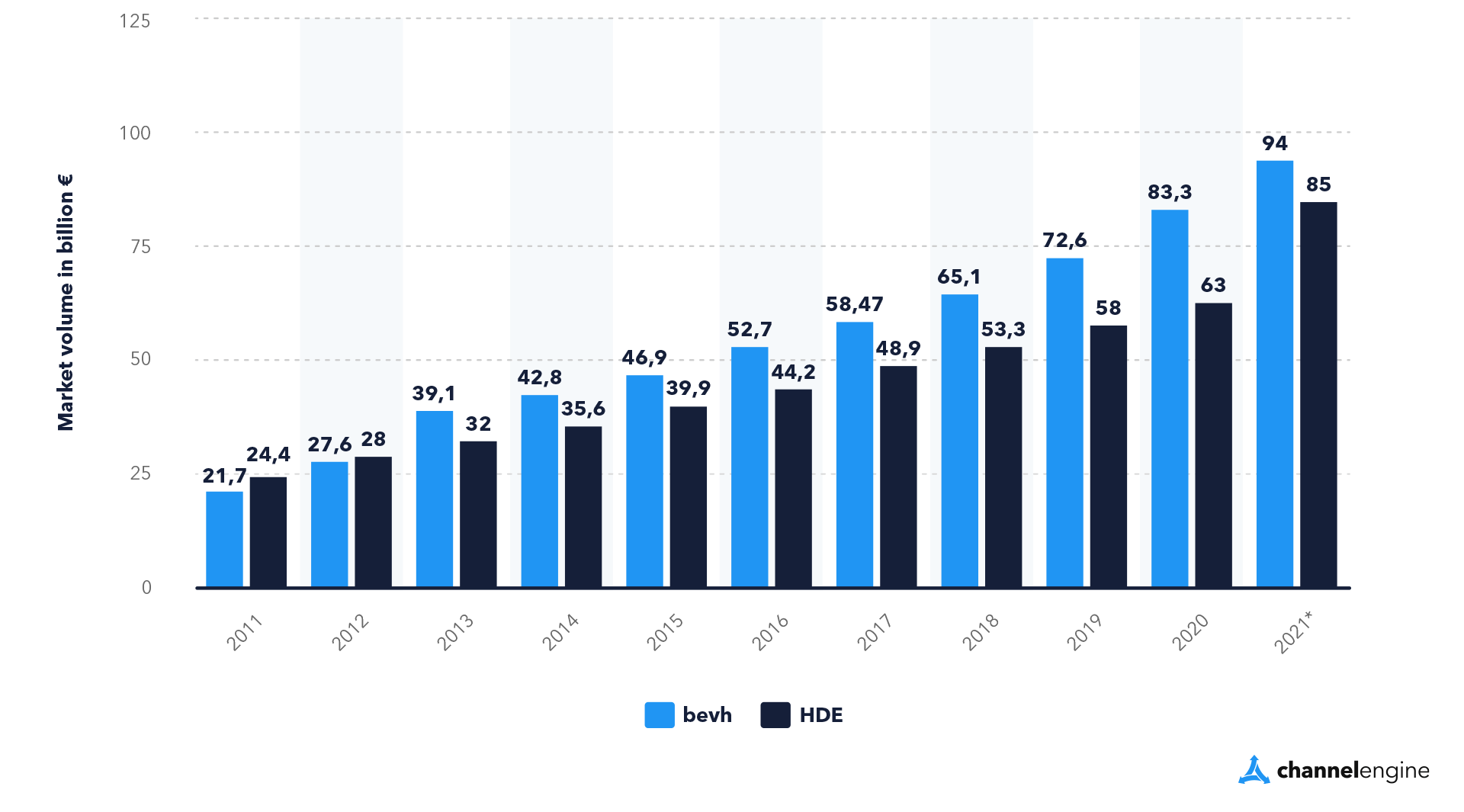

With the pandemic, making brick-and-mortar business being constricted dramatically in 2020, e-commerce experienced an unprecedented boom. According to market figures of the behv (Berlin-based online trade association), the unbroken overall trend towards e-commerce and marketplace sales continues for all types of goods in Germany, where Amazon has clearly been dominating the market.

E-commerce development in Germany

The industry’s trend toward growth continues unabated, even though restrictions on brick-and-mortar retailing have now been eased. In the first half of 2021, there was a consolidated growth of 23.2 percent (from €36.7 billion in H1/2020 to €45.2 billion in H1/2021). In terms of forecasting, e-commerce could exceed the revenue mark of €100 billion for the first time this year. [source]

Figure 1: The development of e-commerce market volume in Germany (2011-2021)

HDE = Handelsverband Deutschland [source]

At 22.5 percent, the most substantial growth in retail sales was achieved by online marketplaces, which currently have a market share of 50.7 percent. As for the popularity of marketplaces, the CEO of bevh, Christoph Wenk-Fischer says:

“Marketplace platforms make it easier for retailers to enter the digital market and give them a high reach. For many of these retailers, these platforms are therefore not just a lifeline, but currently the necessary way to continue to participate in e-commerce alongside the increasing expense of brick-and-mortar business during the pandemic.”

Hence, the number of marketplaces, as well as retailers selling on marketplaces, has increased significantly. If you want to know more about global marketplace growth and how to start selling properly, click here. The biggest marketplace leading the Top 10 German marketplaces is, of course, Amazon. With an estimated net worth of $ 1.7 trillion, the company has dominated the e-commerce sector for years.

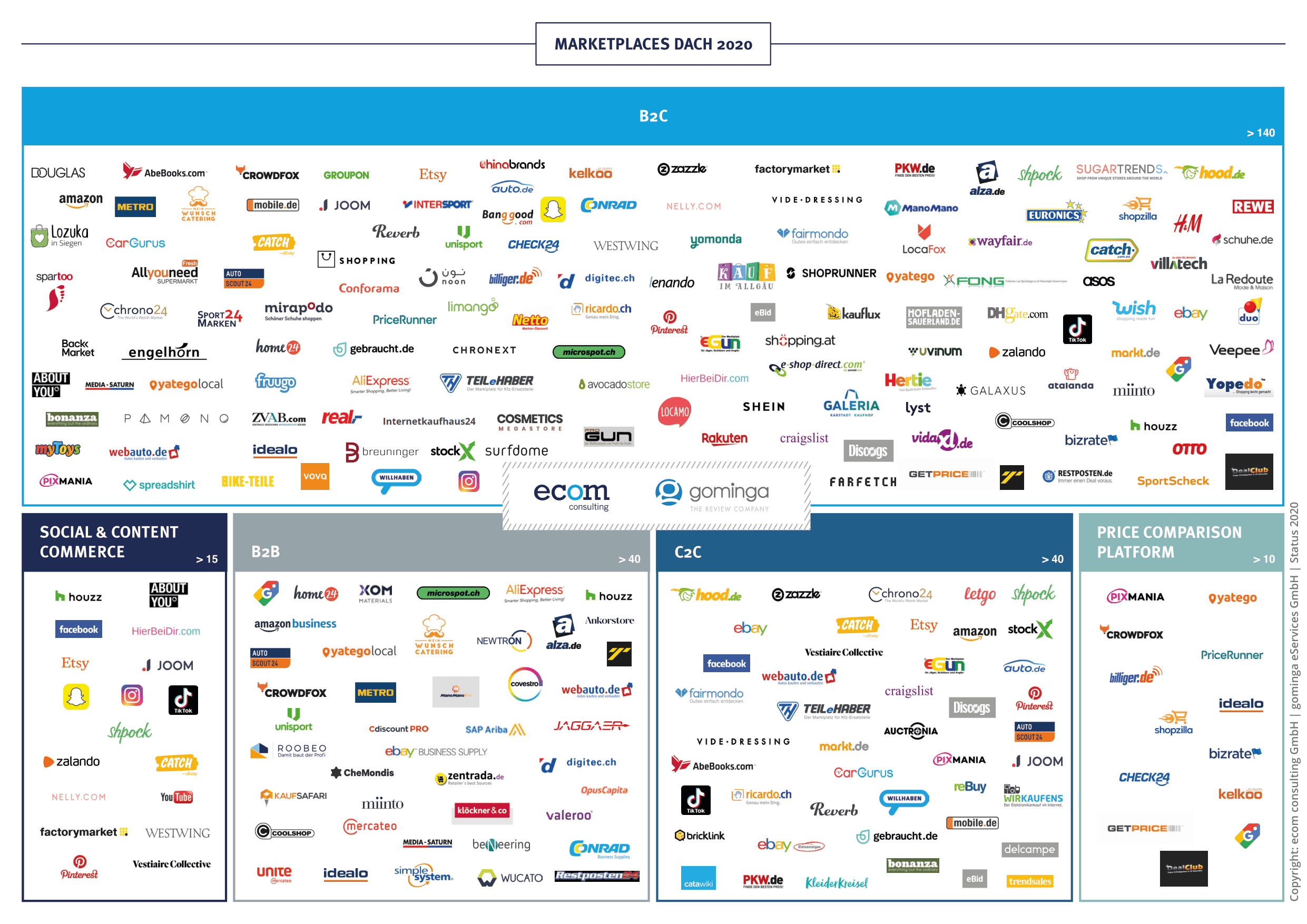

However, there are many more marketplaces to sell on in Germany and the DACH region, as gominga and ecom consulting show in their DACH marketplace landscape, including over 170 marketplaces. But why should you start selling on

platforms if Amazon is the most significant player?

Figure 3: DACH marketplace landscape 2020 [source]

Reasons for selling on German marketplaces alternatively to Amazon Germany

Firstly, there is an increasing number of similar alternatives. Additionally, conducting a marketplace study, gominga, and ecom consulting found out that around 29 percent of the marketplaces currently active in the D-A-CH region, similar to Amazon, also operate their own retail business on their marketplaces. There are over 50 players who compete with their connected manufacturers and dealers on the marketplace itself. Five years ago, this figure was only 19 percent, corresponding to a share increase of over 50 percent.

Secondly, there is little point in betting everything on one card. A seller’s account may be suddenly blocked, and if you don’t diversify and use an alternative platform, your business is paralyzed quickly. Using multiple marketplaces gives you more flexibility in case something goes wrong. Moreover, you get the opportunity to test the other platforms and find out which is the best sales platform for your products.

Thirdly, your products will be made available to a larger audience by selling them on other marketplaces. That being said, you could even save money or find a better platform for your ideal customers trying out different platforms. You could get better customer and supplier support, more shipping options, lower fees, and alternative payment methods compared to Amazon.

Finally, according to Splendid Research’s study regarding the Customer Journey 2021, customer reviews on marketplaces besides Amazon and Google are gaining relevance. Naturally, reviews on online marketplaces such as Amazon and Google still occupy a decisive position in research and information procurement during the customer journey. The study makes it particularly clear that customer reviews on marketplaces are the most important source of information in the information phase

However, a much more considerable increase is recognizable on other marketplaces. [source]

Selling properly on German marketplaces with the right tool

Following the increase of marketplaces and retailers, many tools became available to facilitate entering e-commerce and establish a solid market position. Fulfillment, taxes, pricing, or stock management – you name it. Managing all this on your own becomes especially difficult when you choose to follow this article and execute a multi-channel strategy by selling on multiple platforms. Of course, expertise in each of those fields is required when scaling up, but before being able to optimize, it is of utmost importance to provide a centralized platform where all the management is handled:

ChannelEngine connects your systems to international marketplaces and sales

channels while optimizing sales, minimizing time, and maximizing profit and reach with a single powerful integration. Besides Amazon, the top 10 German marketplace alternatives (figure 2) and many more international platforms are fully integrated into the suite: Find all of them in our marketplace overview.

As for the expertise in each area of e-commerce activity, ChannelEngine provides a broad partner network to handle special customer needs. This network includes gominga, who gladly help you optimize your customer review management as reviews are becoming increasingly important on marketplaces. If you are curious about how our clients benefit from ChannelEngine and their partners, read their success stories here.

Are you interested in becoming a partner or customer of ChannelEngine? Don’t hesitate to contact them!

Not enough? Explore more features on their website.

We’d like to thank our partner ChannelEngine for kindly providing us with this guest article!

Note: In the originally published version, we showed a graph with incorrect or misleading figures. It compared eBay’s revenues with the revenues of online retailers, whereas eBay’s revenues were transaction fees and not trading revenues. Unfortunately, this was a case of comparing apples with oranges. We apologize for this.