The world of e-commerce has evolved enormously because of Covid-19. For example, the pandemic has enabled goals that were not planned until 2024. Despite this successful progress, which was unimaginable before the lockdown, the disappointment is huge. The reason is that the expected progress of five or even ten years, which was to be achieved by the pandemic, has failed to materialize. As a result, a dream has been shattered for some, due to overly high expectations, and this even e-commerce sales have never been so high, starting has never been so easy, and the selection of products has never been so large.

E-commerce development, too high expectations?

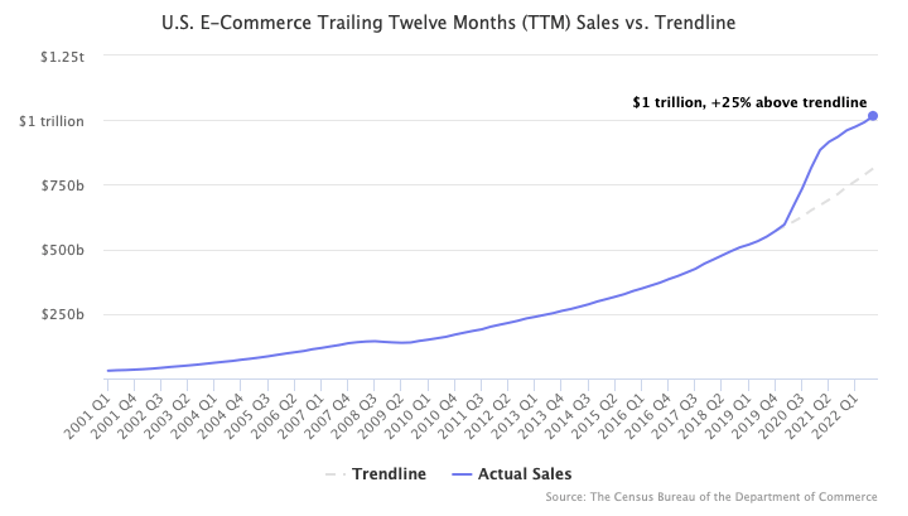

2022 wasn’t the best year for the e-commerce world, but it wasn’t the worst either. In less than two years, the e-commerce industry has gone from euphoria to despair. Two years earlier, everyone assumed that e-commerce was undergoing a long-term transformation as online penetration soared in a matter of months – a process that normally would have taken years. But as the next quarters’ results came in, it quickly became clear that the e-commerce industry would revert to its previous trend. Nonetheless, e-commerce spending in the U.S. surpassed $1 trillion over the previous 12 months in the third quarter of 2022, a milestone that pre-pandemic forecasts predicted would not be reached until 2024. Despite this, e-commerce growth reached $5.8 trillion in 2022. (Asendia & marketplacepulse).

Amazon as a marketplace

As a marketplace, Amazon offers a platform where sellers can sell their products directly to customers. This includes the management of product listings, orders, and deliveries as well as the processing of payments. Sellers also have access to various tools and services to optimize them and strengthen their presence on the marketplace.

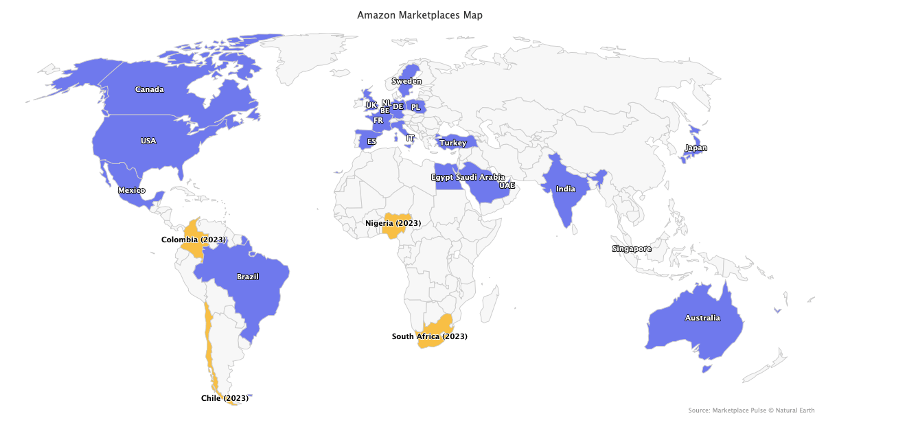

Amazon is present as a marketplace in many different countries and cannot be imagined without it. With the entry of Belgium in October 2022, Amazon now has 21 countries in which you are represented as a marketplace. Belgium is the tenth active marketplace of Amazon in Europe.

Next, Amazon plans to launch in Colombia, South Africa, Nigeria, and Chile. When exactly this will take place is still unclear.

Amazon aggregators

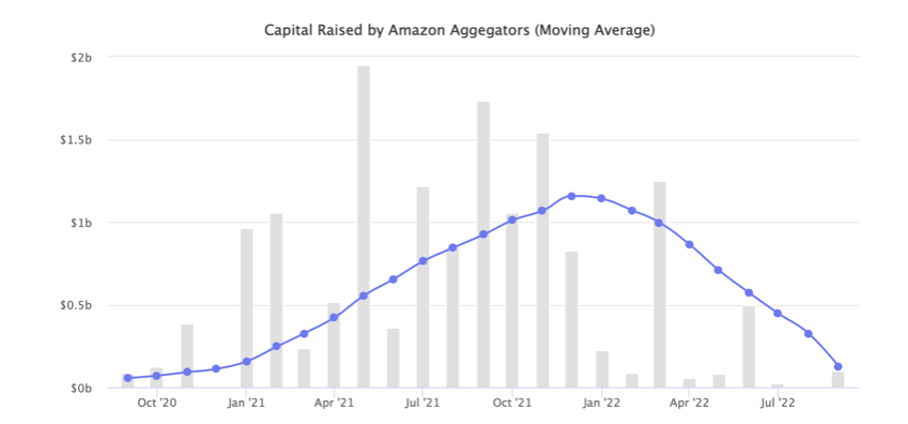

2021 was also known as the year of Amazon aggregators. Amazon aggregators are services that collect product data from various online retailers or manufacturers and then make it available on the Amazon platform. They allow online merchants to sell their products on the Amazon platform without having their own seller account.

The goal of Amazon aggregators is to scale the Amazon brands they acquire to generate revenue for their investors. Due to this, they are looking for innovative partnerships with entrepreneurs to incubate e-commerce brands.

2021 was the boom year in the boom-and-bust cycle used to describe Economics. Over a billion of dollars flowed into fund aggregators monthly in 2021. Due to external and internal factors, this came to a halt in 2022. If 2021 was the year to launch an aggregator and attract seemingly unlimited capital with a virtually copied pitch deck, 2022 was the year of survival in that aggregators had $2.3 billion in new funds. In 2021, it was nearly $9 billion. (marketplacepulse)

Amazon SaaS Eco System

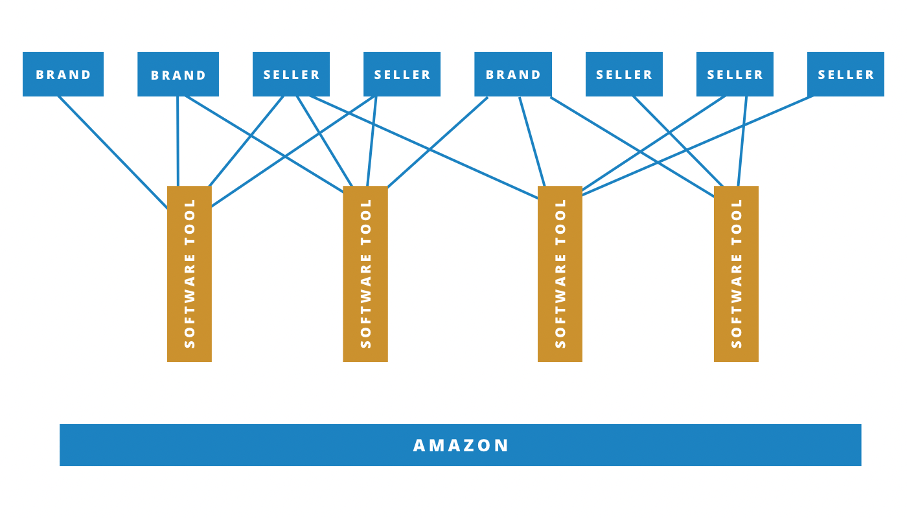

Whether it’s inventory management, product research, pricing, order fulfillment, advertising, accounting, or taxes, tens of software groups help other businesses sell on Amazon. In doing so, sellers use other tools to supplement or replace Seller Central’s functions, while Amazon uses its own Seller Central as a starting point. Brands selling wholesale to Amazon also use some of these tools, as well as a separate set of enterprise tools. Startups in the Amazon ecosystem, however, have received little attention from investors. Only a handful of companies have received investment. Those that haven’t have been so lucky have started their own businesses with the help of their cash flow. This is mainly because Amazon’s API creates a rigid framework that limits the creativity of these companies.

On the other hand, this has developed enormously in the last two years. The financing of Amazon tools has accelerated rapidly, and M&A activity has become more frequent in this regard. As a result, the formerly cash-strapped industry is catching up with the rest of the software-as-a-service (SaaS) market. One of the reasons for the increased interest, are the Amazon seller aggregators that are raising billions of dollars and some of which are reaching valuations of over $1 billion. The aggregators have managed to draw attention to the ecosystem. This means that investors were looking for other types of companies to fund. Software companies operating in this space have been in the blind spot.

Amazon advertising is the fastest growing category within the Amazon ecosystem. This area has more product releases and API changes than all other areas combined. Many leading Amazon advertising software companies have either been acquired or have raised capital. Amazon tool aggregators also exist to acquire and operate a portfolio of tools and combine them into revenue packages to grow.

Buy with Prime

In April, Amazon introduced buy with prime. “Buy with prime” is a feature that allows Prime members to purchase certain products with just one click, without having to re-enter their delivery and payment information. This is possible through the Amazon delivery and payment information that has already been stored in the member’s account.

“Buy with prime” is useful for Prime members who need a quick as well as easy buying process. The feature is not always available, but only for selected products offered by Amazon itself or by partner merchants.

For the past 15 years, Amazon has offered services that allow customers to shop more easily on other merchants’ websites. Initially as Check-out by Amazon, which later morphed into Amazon pay. Through “Buy with Prime “, amazon pay merged with amazon fulfillment. This also guarantees delivery times and free shipping, so payments are processed. A convenience feature that competes with Apple Pay and other providers.

Social Commerce

Social commerce refers to the sale of products or services via social media platforms. This includes, for example, the ability to buy products directly within an Instagram or Facebook post, or via live shopping features on TikTok. Businesses that use social commerce can reap benefits such as increased visibility and engagement. Through interaction options such as “liking” or “sharing” posts, businesses can build direct interaction with their customers, increasing engagement.

“Mark Zuckerberg had high hopes for turning Facebook and Instagram into shopping destinations. Now the venture he once focused on intensely has been reduced to advertising,” Sylvia Varnham O’Regan wrote for The Information. “Meta’s CEO had high expectations for the company’s foray into online shopping. But now Meta is scaling back its commerce ambitions after internal strategy debates, sluggish sales and a deepening ad revenue crisis.” In another article, Sylvia wrote, “Instagram plans to drastically scale back its shopping features, the company told Instagram employees Tuesday, as it shifts the focus of its e-commerce efforts to those that directly promote advertising.”

Social networks like Instagram have introduced features such as in-app checkout, which allow users to make purchases directly within the app. While these features haven’t necessarily directly increased sales, they are important platforms for product discovery and thus bring in revenue through advertising.

An example of this is Prime Day in the U.S., where videos with the hashtag #primeday2022 were viewed 77 million times on TikTok, compared to 30 million in 2021 and 6 million the year before. In 2019, there were virtually none. So TikTok is not only used for entertainment, but also for shopping-related content. Shoppers use TikTok to find the best deals instead of looking on Amazon directly, as the range of offers during Prime Day is often overwhelming and confusing.

E-Commerce 2023

Inflation and supply chain difficulties have been some of the reasons for low sales growth in 2022 so far. Although these problems will not disappear completely in 2023, there are signs that there will be an improvement. Expected trends in the coming year will help with this.

The level of online retail sales in the coming months will depend heavily on retailers’ ability to deliver. According to Hansjürgen Heinick, online market expert at IFH Cologne, it is crucial that the ability to deliver can be maintained without any problems. He says: “If the overall economy becomes more positive again, this will also have an impact on online retail sales. In our various scenarios, we expect positive growth rates through 2026.” It is thus obvious that retailers should optimize their supply chains to be successful in online retailing.

Another factor that can boost online retail sales is the “buy now, pay later” payment method. As early as 2022, many payment service providers have already focused on this option. Some consumers are increasingly opting for this type of payment, often through providers such as Klarna, Afterpay or PayPal, due to the economic impact of the crisis. This payment method originated in the U.S. and is now becoming increasingly popular in Germany. However, service providers may pass on the costs to merchants, which can lead to rising costs. (t3n)

More about marketplaces

Find out more about the recent trends and drivers of the

marketplace world in our gominga study “Marketplace World 2022“.